Carmanah Technologies Corporation (TSX: CMH) (“the Company” or “Carmanah”) today reported its fourth quarter and fiscal 2017 financial results for the periods ended December 31, 2017. Currency amounts are in U.S. dollars unless otherwise noted.

All figures below, unless otherwise stated, are for Carmanah’s continuing operations and exclude the operating results from the Company’s Power business segment. The company completed the sale of the On-Grid division on April 3, 2017 and the sale of the Off-Grid division on August 1, 2017.

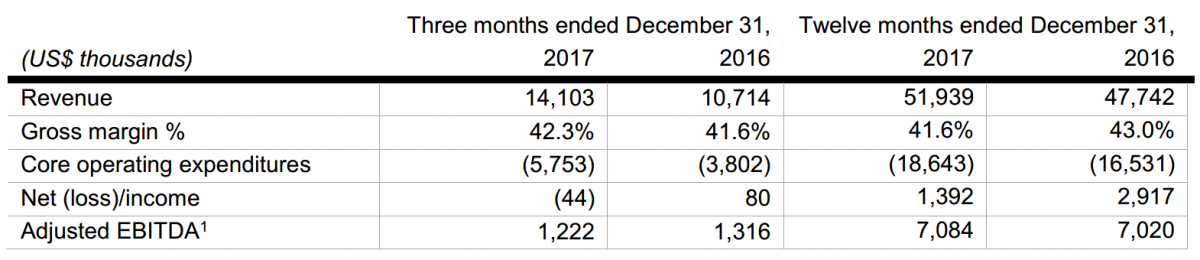

Fourth Quarter Revenues and Profitability

In the fourth quarter of 2017, we generated revenues of USD $14.1 million, up USD $3.4 million or 31.6% over the fourth quarter of 2016 revenues of USD $10.7 million. The increase in revenues was attributed to exceptionally strong performance from most of our Signals verticals, which generated revenues of USD $13.3 million, up USD $4.5 million or 50.9% over the fourth quarter of 2016 revenues of USD $8.8 million. The Marine vertical now includes the revenue of Vega. Excluding the Vega and EKTA revenue contribution, the Signals vertical’s organic growth was USD $2.9 million, up 32.3% over the fourth quarter of 2016. Conversely, the Illumination segment generated revenues of USD $0.8 million, down USD $1.1 million or 59.1% over the fourth quarter of 2016 revenues of USD $1.9 million, as we continued the transition to our next generation EverGen product.

Gross margin percentage in the fourth quarter of 2017 was 42.3% up 0.7%, over the same period in 2016.

Core operating expenditures in the fourth quarter of 2017 were USD $5.8 million, up from US$3.8 million in the fourth quarter of 2016. The increase was due to higher product development activities, the amortization of acquired intangible assets from Vega and EKTA and the overall increase in G&A expenses associated with the acquisition of Vega.

Net income in the fourth quarter of 2017 was USD $(0.05) million down from USD $0.1 million in the fourth quarter of 2016. Fourth quarter of 2017 net income was negatively impacted by restructuring costs of USD $0.5 million, also principally associated with the Vega acquisition, as well the increase in core operating expenses noted above. Carmanah has an aggressive integration plan for Vega in 2018 that is expected to deliver targeted cost savings.

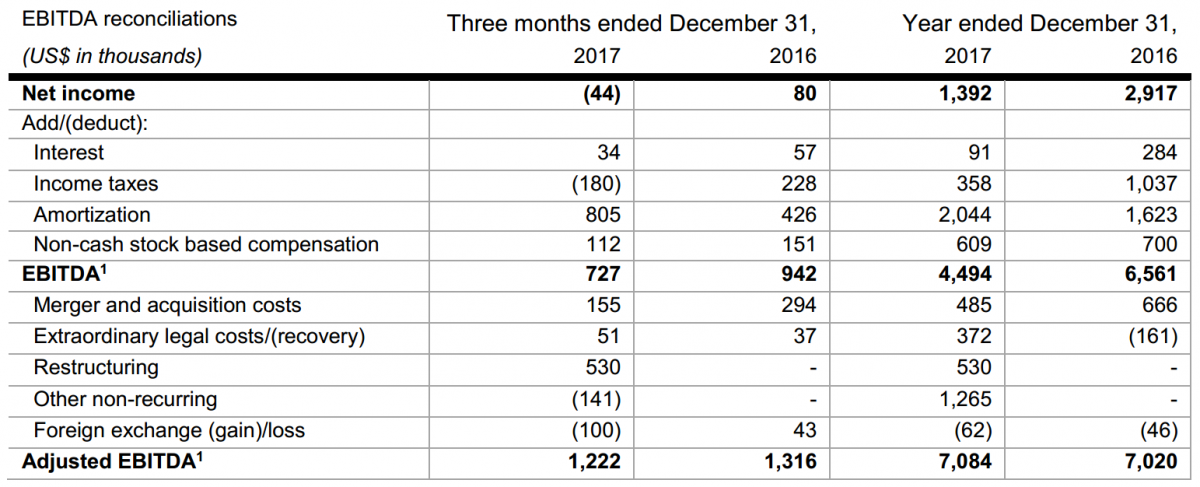

Carmanah management relies on Adjusted EBITDA1 (a non-IFRS measure) to gauge financial performance. In the fourth quarter of 2017, the Company generated Adjusted EBITDA of USD $1.2 million, down 7.1% from USD $1.3 million in the same period in 2016. A table reconciling net income and Adjusted EBITDA is included in this release.

Fiscal 2017 Revenues and Profitability

For the year ended December 31, 2017, we generated revenues of USD $51.9 million, up USD $4.2 million or 8.8% over 2016 revenues of USD $47.7 million. The Signals segment generated revenues of USD $48.0 million, up USD $8.1 million or 20.3% over 2016 revenues of USD $39.9 million. This growth included USD $5.1 million or 12.7% from organic growth. The Illumination segment generated revenues of USD $3.9 million, down USD $3.9 million or 49.7% over 2016 revenues of USD $7.8 million.

Gross margin percentage for the year was 41.6%, down 1.4%, over the same period in 2016.

Our total core operating expenses for the year were USD $18.6 million, up from USD $16.5 million in 2016. A majority of this increase was due to the same factors apparent in the fourth quarter of 2017. Net income for the year was USD $1.4 million, down from $2.9 million in fiscal 2016.

For the year ended December 31, 2017, Adjusted EBITDA was $7.1 million or 13.6% of revenue, roughly comparable to the $7.0 million, or 14.7% of revenue, reported in the same period in 2016.

“2017 was a very active year for Carmanah during which we made significant progress towards our plan to increase focus and enhance our Signals segment leadership. We acquired two marine aids-to-navigation businesses that we are in the process of consolidating into our global marine business to expand our product platform and deliver targeted cost savings. These acquisitions, together with solid organic growth, helped to solidify our aids-to-navigation market leadership.” said John Simmons, CEO. “And while we are pleased with our Signals business progress in 2017, our Illumination business remained challenging. During 2017, we streamlined our Illumination product offering and revamped our approach to the market. We are hopeful that these investments will help us reverse recent revenue declines and return this business to both growth and profitability. Early signs are encouraging, as our Illumination backlog entering 2018 stood at USD $1.3 million, up from USD $0.6 million a year earlier and USD $0.3 million at the end of the third quarter of 2017.”

Highlights for the quarter are provided below:

Financial Condition at December 31, 2017 compared to December 31, 2016

• Cash and cash equivalents of USD $11.8 million, down USD $10.1 million from USD $21.9 million, primarily due to the acquisitions of EKTA and Vega, and our Substantial Issuer Bid.

• Working capital of USD $21.2 million, down USD $0.4 million from USD $21.6 million

Complete set of Financial Statements and Management Discussion & Analysis

A complete set of the fourth quarter ended December 31, 2017 Financial Statements and Management’s Discussion & Analysis are available on Carmanah’s corporate website. To view these documents, visit: https://carmanah.com/company/financial-reports. Both documents are also filed on SEDAR (www.sedar.com). The financial information included in this release is qualified in its entirety and should be read together with the audited consolidated financial statements for the year ended December 31, 2017, including the notes thereto.

EBITDA and Adjusted EBITDA1

About Carmanah Technologies Corporation

Carmanah designs, develops and distributes a portfolio of products focused on energy optimized LED solutions for infrastructure. Since 1996, we have earned a global reputation for delivering durable, dependable, efficient and cost-effective solutions for industrial applications that perform in some of the world’s harshest environments. We manage our business within two reportable segments: Signals and Illumination. The Signals segment serves the Airfield Ground Lighting, Aviation Obstruction, Offshore Wind, Marine, Traffic and Telematics markets. The Illumination segment provides solar powered LED outdoor lights for municipal and commercial customers.

Contact

Carmanah Technologies Corporation:

Evan Brown, (250) 380-0052

Chief Financial Officer/Corporate Secretary

investors@carmanah.com

This release may contain forward-looking statements. Often, but not always, forward-looking statements can be identified by the use of words such as “expects,” “estimates,” “could,” “will” or variations of such words and phrases. Forward-looking statements or information in this news release relate to, among other things: revenues, and revenue growth, for the fourth quarter and year ended December 31, 2017; order backlogs; gross margins and estimates of EBITDA and Adjusted EBITDA. Forward-looking statements involve known and unknown risks, uncertainties, and other factors which may cause the actual results, performance, or achievements of Carmanah or Sabik to be materially different from any future results, performance, or achievements expressed or implied by the forward-looking statements. Such factors include, but are not limited to: our ability to become a worldwide leader in the marine aids to navigation industry, the potential growth of the off-shore wind safety market or our ability to participate in any growth and other general uncertainties that may impact actual outcomes. These forward-looking statements are based on management’s current expectations and beliefs but given the uncertainties, assumptions and risks, readers are cautioned not to place undue reliance on such forward-looking statements or information. Carmanah disclaims any obligation to update, or to publicly announce, any such statements, events or developments except as required by law.

For additional information on these risks and uncertainties, see Carmanah’s most recently filed Annual Information Form (AIF) and Annual MD&A, which are available on SEDAR at www.sedar.com and on the Company’s website at www.carmanah.com. The risk factors identified in Carmanah’s AIF and MD&A are not intended to represent a complete list of factors that could affect Carmanah.